The rise of ESG and why it matters

Wednesday 28 September 2022

By Gillian McKee of Giraffe Associates Ltd.

Is it different from sustainability?

What doesn’t really matter so much when it comes to your own business and ESG is what you call it. If you are considering and addressing your company’s sustainability, you will effectively be looking at all the same issues as if you develop an ESG strategy – you might just present it slightly differently. Yes, you’ll find articles out there claiming that the two are in fact different, and I don’t wholly disagree, but it’s only in a very nuanced way. Ultimately, ESG done properly is about focusing on the things that help to make your business sustainable.

The rise of ESG and the push towards it from investors simply adds further impetus to act and ensure that you’re measuring, monitoring and reporting on those non-financial indicators of performance. Although it can in many ways be seen as an evolution of what companies previously would have called Corporate Responsibility (CR), ESG brings a level of rigour in the form of investor scrutiny and public reporting that CR lacked. It also requires companies to disclose their material impacts, where for many businesses, CR was more about a separate programme of activity carried out in addition to day-to-day operations.

What issues should I be looking at?

But enough of the high-level analysis of what ESG is. Let’s look at what sorts of ESG issues might be relevant. As you might expect, this will differ depending on your sector, products, business model, customers, and purpose. For example, a small business consultant with a fairly localised customer base operating from one office is likely to disclose its impacts on a different set of ESG topics from an international manufacturer of agri-food products with a global footprint and supply chain.

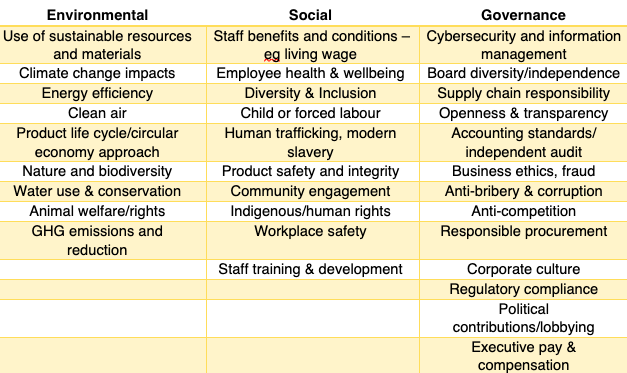

That said, the table below provides a checklist of some of the topics that a business should consider to determine how material they are to any ESG strategy or report.

ESG is increasingly gaining prominence, leading many companies to question whether it is something they need to be ‘looking at’ and if or how it differs from sustainability or corporate responsibility. I’ve noticed many companies gravitating towards using the term ESG, primarily because there’s a feeling that it’s current and ‘where it’s at’ just now and so they feel a need to comply, even if (and this is the case for many), they don’t have investors and aren’t seeking investment any time soon. And that’s the crux of it really. ESG, which stands for Environmental, Social and Governance, has come from a growing awareness within the investor community of the need for more accountability and a focus on non-financial reporting by the companies in which they invest. It is a further manifestation of the shift towards companies accounting for how they serve the interests of stakeholders and take account of their impact on the world around them.

It matters. A lot. This is because investors – financial institutions, private, institutional investors and banks – can hold a lot of power. Sometimes enough to dictate the difference between business survival or collapse. You may have already noticed your bank starting to ask questions about your environmental and social impacts, or maybe specifically your emissions and plans for reaching net zero. If you haven’t, prepare yourself – these questions are coming. At this stage, some banks and investors are simply asking to get a feel for where their clients are on these issues and there may not yet be any penalty for lack of action or ambition. Very soon though, being able to demonstrate a commitment to ESG factors could impact directly on the funding available to you. That’s because banks have a key role to play in net zero and are seen by many as key to the UK achieving a much-needed green recovery.

What might it mean for my business?

What businesses are seeing now with the rise of ESG is that they are having to take account of the impact their operations have on the environment, on social institutions and human interactions and on how they are governed and make decisions. For many businesses, these may be issues they haven’t given much thought to, so there’s potential for significant cultural and operational change to come about as a result of reviewing the business with an ESG lens. Often these changes can bring improved efficiencies, increased resilience and can ultimately make the business more sustainable. You may want to undertake a structured review to start with. You can of course appoint a consultant to work with you on this, but an initial starting point might be to go through the very comprehensive Business Impact Assessment that is freely available online and is a precursor to applying for B Corps certification. Even if you’ve no intention of becoming a B Corporation, it’s a brilliant health-check tool to assess where your strengths and weaknesses are when it comes to being a responsible, sustainable business. If you want more information on this, do get in touch. I’ve trained as a B Leader, so have a good insight into the tool and what’s involved in B Corps certification.

Does it really apply to my business?

The final question (or maybe the first) you might have, is whether ESG is really something your business needs to take notice of. Perhaps you’re a very small business and you don’t rely on investors – you might feel it’s irrelevant to you. That’s understandable. You probably don’t need a full-blown ESG strategy. What you do need however, and what I would argue every business of any size and any sector needs, is to consider how your business impacts on people and the planet and to take steps to reduce or remove anything negative. That’s just good business. Consider factors other than pure profit in running your business. If you don’t, chances are you may not be around too long and you may also be missing out on opportunities to optimise your profits.

As I mentioned at the start of this piece, ESG has come from the investment community and it’s driving considerable growth in sustainable investing. Globally, sustainable funds based on ESG themes pulled in $20.6 bn of new money in 2019 – almost quadruple the 2018 figure. That makes it a considerable economic force and it’s one that is continuing to grow, with an estimate that by 2025, 33% of all global assets under management will have ESG mandates. So, does it matter? I’d say it does – both economically and ethically.

Further information: Gillian McKee on 07711 367794 or email gillian@giraffeassociates.com

Wednesday 28 September 2022

Contact us

Contact us

Share on social

Share on social Share with a friend

Share with a friend Facebook

Facebook LinkedIn

LinkedIn

Twitter

Twitter

Get in touch with us

Get in touch with us